Tesla has been a global leader in EV manufacturing, but since the late 2010s, the EV landscape has changed drastically. New players have entered the market, and global giants like Porsche and Hyundai have ventured into the EV space. Looking ahead to 2025, Tesla has its sights set on the Indian market. However, with strong domestic competitors like Mahindra and Tata offering a range of EVs, the question arises—can Tesla successfully compete in India? Let’s dive in and find out.

India’s EV Market

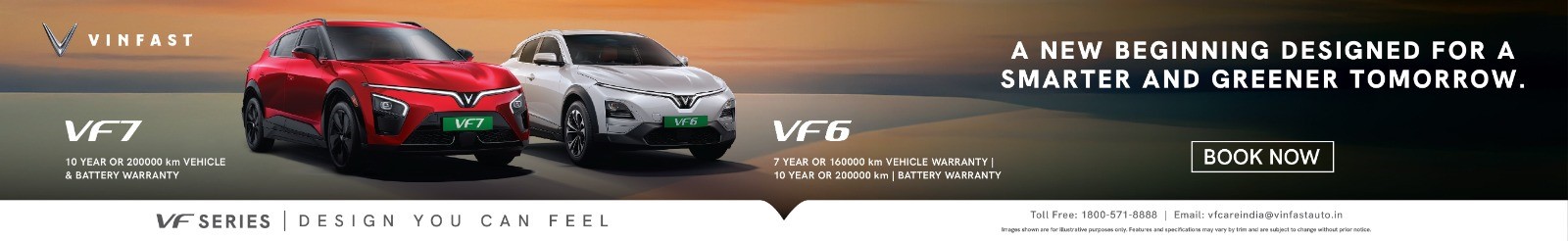

In 2024, over 1.7 million electric vehicles were sold in India, and by 2030, this number is expected to increase by 40–45%. With such rapid growth, global brands are eager to enter the Indian market and claim their share. In 2025, Vietnam’s largest EV manufacturer, VinFast, also entered the Indian market.

To further boost EV adoption, the Indian government is set to introduce a new EV policy, reducing import duties on electric cars from 110% to 15%. This policy shift, combined with strong market demand, creates an attractive opportunity for EV manufacturers while also providing the government with a revenue stream.

Competition

India’s EV market offers a wide range of options across various segments, thanks to established players like Tata, MG, BYD, Mahindra, and Hyundai. Competing with these brands will be a significant challenge for Tesla.

-

Tata dominates the budget and mid-range EV segments with a diverse lineup.

-

MG has gained traction with models like the Comet and Windsor.

-

Mahindra enjoys strong brand loyalty due to its iconic ICE vehicles, such as the Thar, Scorpio, and XUV700. The company also recently introduced BE6 and XEV 9e with competitive pricing.

-

Hyundai benefits from an extensive dealership network offering Ioniq 5, Creta Electric, and more EVs.

-

BMW and BYD lead the EV market in the premium segment beyond these brands.

Tesla’s biggest challenge in India will be standing out in this competitive space. Additionally, Tesla does not spend on traditional marketing, and selling cars without aggressive promotion in India could prove difficult.

Conclusion

Tesla has been facing global challenges in selling its cars, and the Indian market is one of the toughest to crack. Established brands already dominate the space, making rapid sales growth unlikely. The Cybertruck could serve as Tesla’s standout product in India, but its unconventional design may not appeal to everyone. Tesla’s success will ultimately depend on its pricing strategy and positioning itself within this highly competitive landscape.

.webp)